A Subprime Mortgage Can Best Be Described as Follows

It typically carries a higher interest rate that can increase over time. They were described as ninja financing where applicants may get a mortgage no business zero income and no property.

A Study On Subprime Mortgage Crisis

This approach can best be characterized as using nonprice credit rationing.

. Called subprime mortgages these poor credit home loans are designed to offer homeownership opportunities to consumers whose credit score may not meet the minimum standard of a traditional lender or who might have a higher debt-to. Subprime mortgages are loans for individuals who do not qualify for a conventional loan due to credit or other financial reasons. The United States subprime mortgage crisis occurred in 2007 and 2008 and was characterized by a rise in the number of subprime defaults foreclosures and the subsequent decline of securities backing mortgages.

Can I Get A Subprime Mortgage. The subprime mortgage market did not have it easy after the housing crisis. In many cases it is not possible to get a mortgage when your credit score is too low.

The recent crisis in the subprime mortgage market is at least partly the outcome of this new approach to monetary policy. To their credit subprime mortgages got their name from the type of borrowers they cater to and not the interest rate see Questions 4 and 5. Subprime mortgages offer poor credit borrowers the opportunity to purchase homes with better credit rates as well as a.

A subprime mortgage is normally issued to borrowers with lower credit ratings. That crisis has already had widespread ramifications for homeowners and. The prime rate is a benchmark rate that banks use when pricing their variable-rate loans.

In general lenders prefer lenders with 600 to 660 points of credit score. High-risk mortgage loans that are six times household incomes could wipe out 20 per cent of the major banks equity base a 10 billion Melbourne fund manager has warned. More people are falling into the subprime category than ever before.

Top 5 Subprime Mortgage Lenders. The Great Recession has been described by economists as the great recession of the 20th century. In a MBS backed mortgage market anyone can get a loan.

The securitization process is subjected to the following key frictions. What is a subprime mortgage. However the sub prime market has introduced many different pricing tiers and product types which has helped to move the mortgage market closer to price rationing or risk-based pricing.

There are options to obtain mortgages for bad credit from bad credit mortgage lenders. A subprime mortgage is a loan product given to consumers who have i poor or bad credit history ii low credit score iii filed for bankruptcy andor iv been denied of traditional home purchase loans. With a prime mortgage a conventional loan the down payment requirements can be relatively small too as low as 3 percent or 5 percent of.

Securitization can be described as the process in which loans are removed from the balance sheet of the lenders and transformed into debt securities purchased by investors. Subprime mortgages are the type of home that can be acquired by people with no credit history at all but low credit or no credit at all. The success of the subprime market will in part determine how fully the mortgage.

The Subprime Mortgage Crisis. Lenders were the biggest. Key Frictions in Subprime Mortgage Securitization.

A The calculation used to determine how much can be held in an escrow account. The following is a special guest post by Professor Katie Porter Former Credit Slips guest-blogger Max Gardner is always trying to understand the real mechanics and economics of mortgage servicing. By far the most common subprime home loan is the adjustable-rate mortgage ARM which starts with an affordable rate then shifts to a floating rate tied to a published central-banking interest rate such as the one-year London Inter-Bank Offer Rate LIBOR.

Deflation in the 21st century occurred in a period ranging from 2007 through 2008 around the time of the subprime mortgage crisis. Friction between the Mortgagor and the Originator. Subprime mortgages burst the housing bubble by giving home loans to people that did not afford her or him.

The subprime mortgage crisis was the collective creation of the worlds central banks homeowners lenders credit rating agencies underwriters and investors. Those Mortgage Backed Securities whose borrowers risk profile is too low example MBS 650 is classified as subprime mortgage. The minimum credit score is 400 even though subprime mortgages can be written only for borrowers who have lower credit scores.

Borrowers with strong credit profiles can borrow money at the prime rate or below while those with poor credit have to get subprime loans. Which of the following describes a subprime mortgageAThe rate of interest is less than the prime rate of interest BThe loan-to-value ratio is below average CThe life of the mortgage is less than 25 years DThe credit risk is high. Terms in this set 13 The term escrow analysis refers to.

At one of his infamous Bootcamps he had an employee at a now-deceased mortgage servicer share an insiders perspective on default mortgage servicing. A subprime mortgage is a type of mortgage that charges an interest rate higher than the prime rate. Loan for everyone.

During this time nearly 80 of mortgages issued in the United States were given to subprime. Total 50 1000 1000 The survey results show that majority of the participants that is about 37 people thinks that real estate prices could be considered as one of the root cause for subprime mortgage crisis. B The calculation used to determine whether or not a mortgage qualifies as a high-cost loan under section 32.

Based on the numbers cited by the Journal using Inside Mortgage Finance data lenders originated 6 billion in loans to subprime and non-prime those using alternative income documentation to qualify borrowers during the first quarter of 2017. C The process used to reconcile differences in comparables on an appraisal. It can be observed from the fact that people were buying expensive homes in relation to the expectation that prices for homes will.

Chapter 1 Financial Crises Explanations Types And Implications In Financial Crises

A Study On Subprime Mortgage Crisis

Pdf Subprime Lending And Credit Risk Management In Securitization

Real Effects Of The Subprime Mortgage Crisis Is It A Demand Or A Finance Shock In Imf Working Papers Volume 2008 Issue 186 2008

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Illiteracy And Customer Credit History

Pdf Subprime Mortgage Crisis In The United States In 2007 2008 Causes And Consequences Part I

Real Effects Of The Subprime Mortgage Crisis Is It A Demand Or A Finance Shock In Imf Working Papers Volume 2008 Issue 186 2008

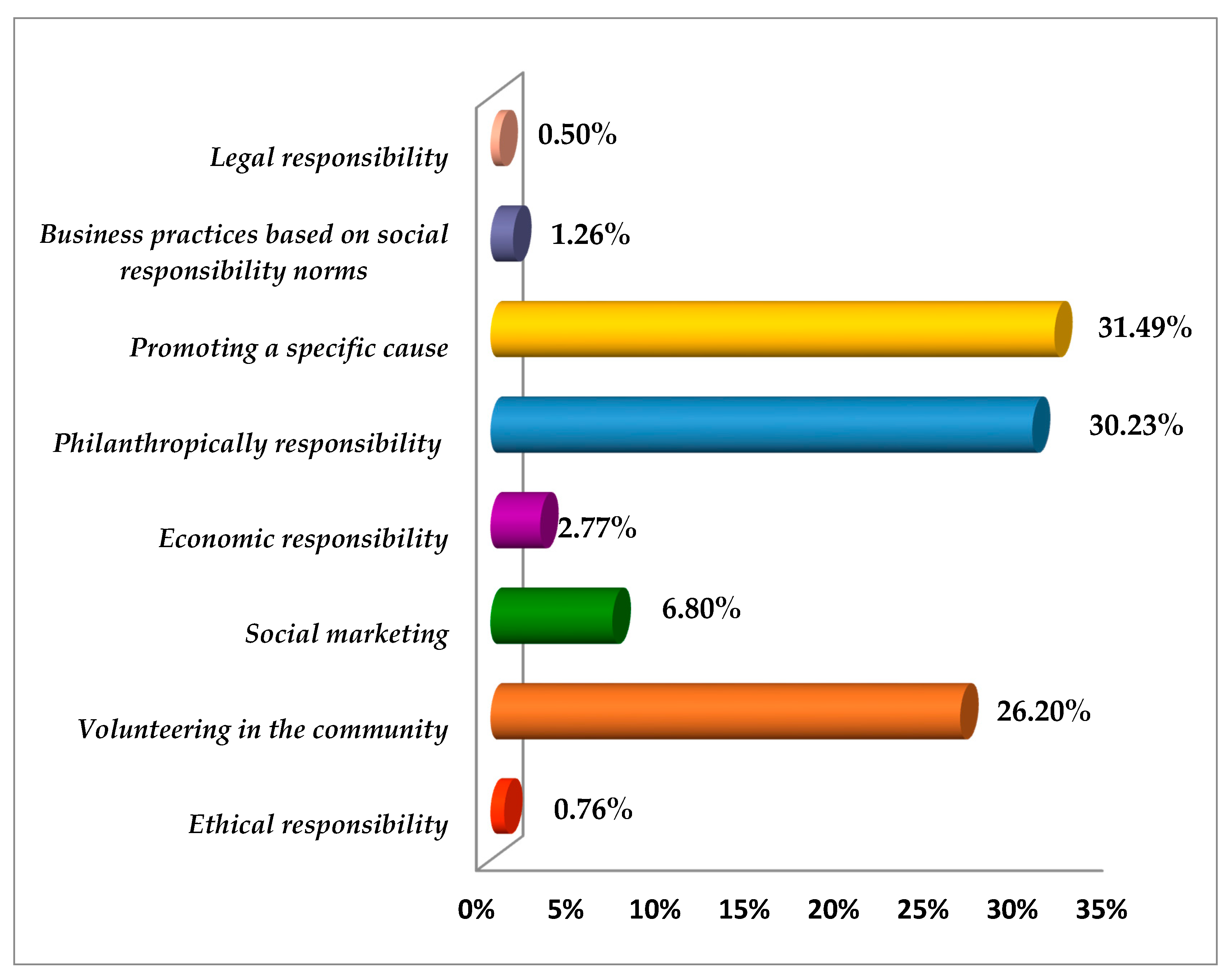

Jrfm Free Full Text An Exploratory Study Based On A Questionnaire Concerning Green And Sustainable Finance Corporate Social Responsibility And Performance Evidence From The Romanian Business Environment Html

Real Effects Of The Subprime Mortgage Crisis Is It A Demand Or A Finance Shock In Imf Working Papers Volume 2008 Issue 186 2008

Pdf Subprime Mortgage Crisis In The United States In 2007 2008 Causes And Consequences Part I

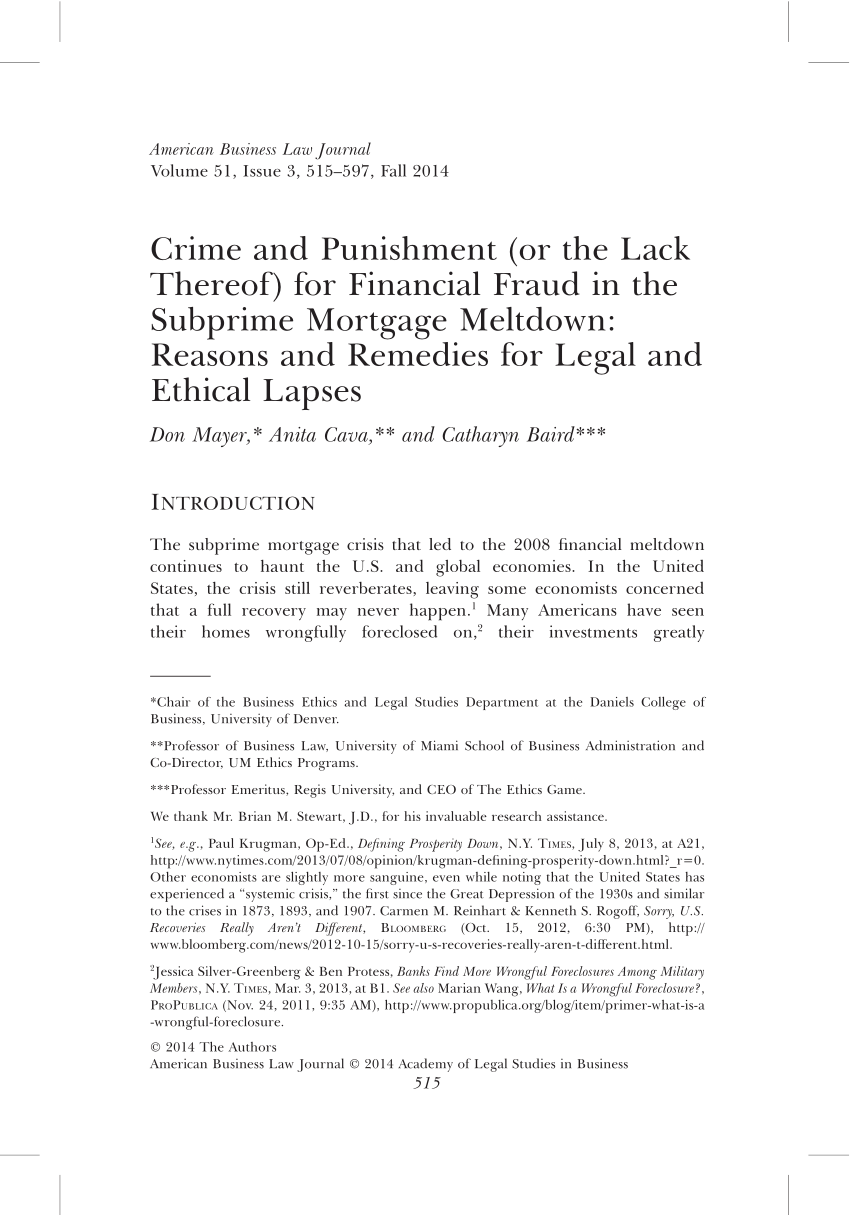

Pdf Crime And Punishment Or The Lack Thereof For Financial Fraud In The Subprime Mortgage Meltdown Reasons And Remedies For Legal And Ethical Lapses

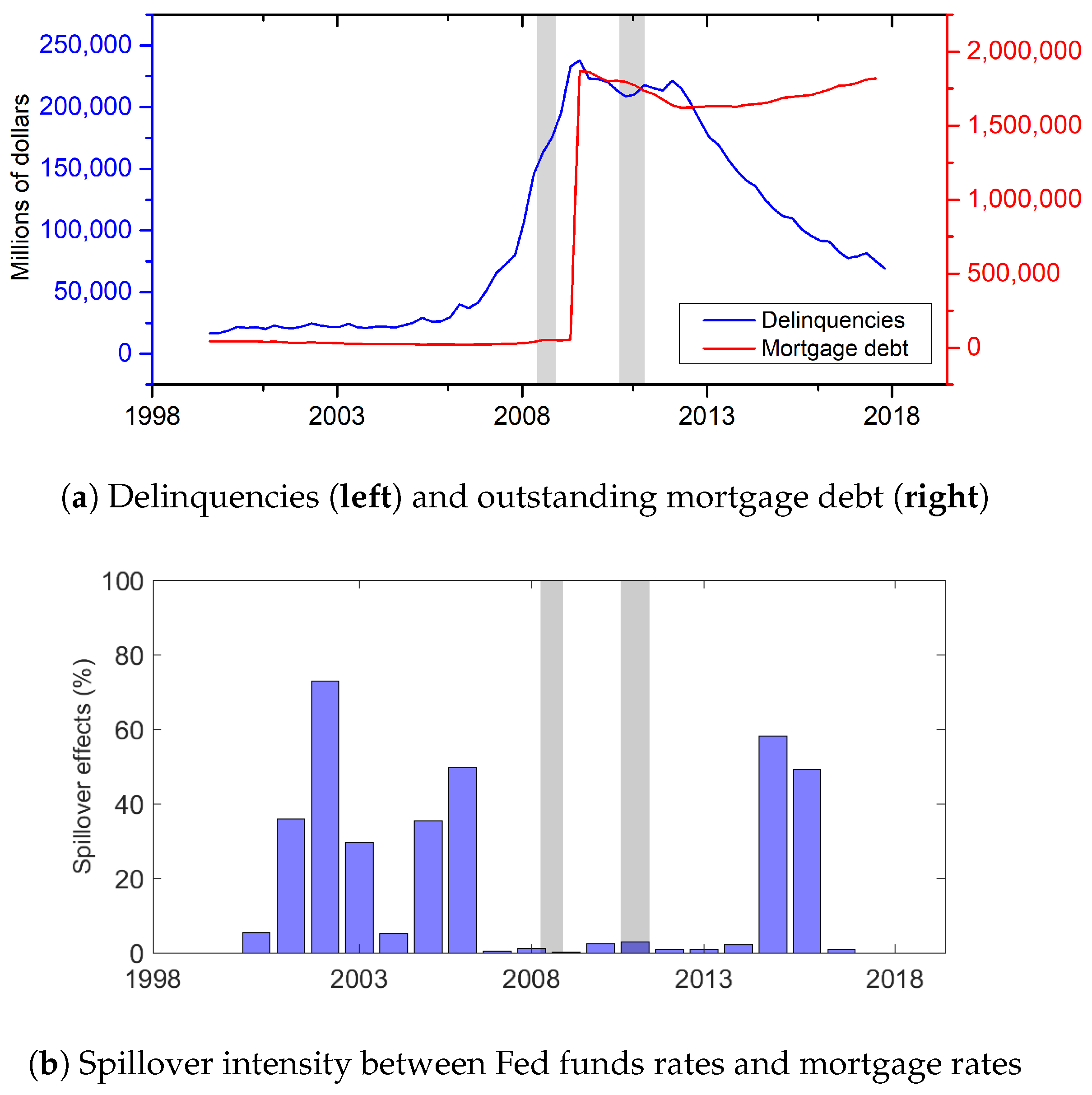

Sustainability Free Full Text Real Estate Soars And Financial Crises Recent Stories Html

Pdf Subprime Mortgage Crisis In The United States In 2007 2008 Causes And Consequences Part I

Pdf Chapter 1 The Nature Of Real Estate And Real Estate Markets Junjie Li Academia Edu

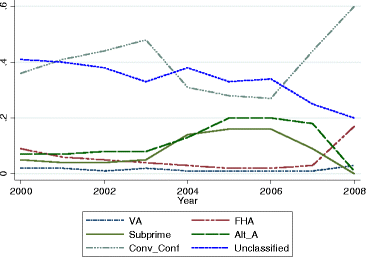

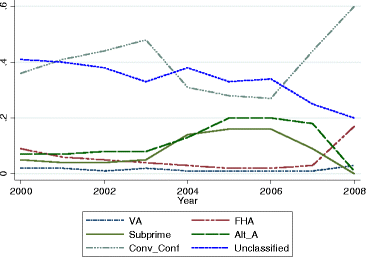

Fha Vs Subprime Mortgage Originations Is Fha The Answer To Subprime Lending Springerlink

Subprime Mortgage And Subprime Mortgage Backed Securities Mbs In The Download Scientific Diagram

Real Effects Of The Subprime Mortgage Crisis Is It A Demand Or A Finance Shock In Imf Working Papers Volume 2008 Issue 186 2008

Comments

Post a Comment